Niche Multifamily Investing for 600% IRR+ Case Study

This case study illustrates how Cross Mountain Capital achieves exceptional returns in “under the radar” markets in Vermont and New Hampshire, where we hold high yield cash flow portfolios. These markets are characterized by historically strong demand fundamentals, limited inventory, and a dearth of existing real estate operators. In addition to acquiring assets at favorable pricing, our success in these markets is due to CMC’s self-management of the portfolio through our in-house asset management division, MSA Properties, LLC, which allows us to achieve operational efficiencies and cost savings.

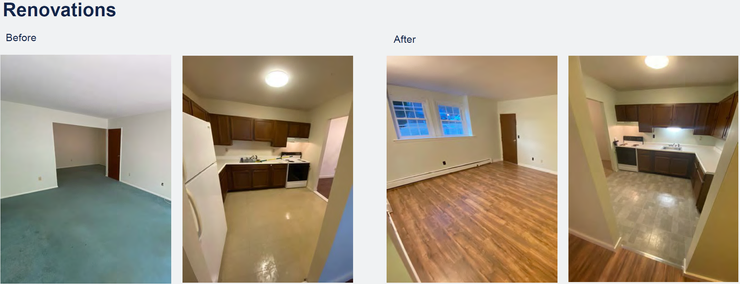

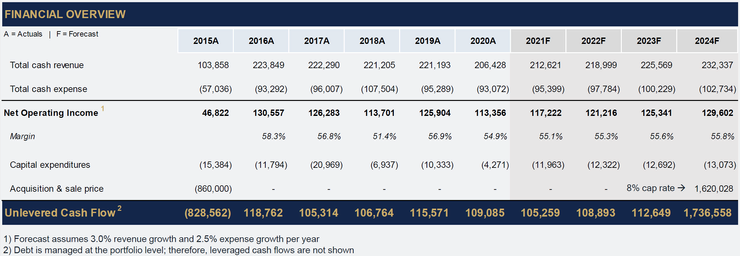

This example involves the 20 unit School House Apartments, which belongs to a larger portfolio in the region. The property was purchased in 2015 using creative financing. A bank provided a regular way commercial loan at 75% LTV and an additional 20% of leverage was obtained through a line of credit. The building was acquired at a 9% cap on “as is” basis, so debt service was a non-issue. During the hold period, renovations were accomplished on a gradual basis with a small budget of $1K – $5K per unit for maximum ROI, as leases expired and rents were increased upwards of 20%.

The table below summarizes returns and financials:

As with most cash flowing multifamily investments, the value and returns won’t “evaporate” with market volatility or investment fads. Your investment is in fact made out of stone and brick. Can the same be said about crypto currencies and stocks that have grown entirely divorced from fundamentals? We are always on the lookout for similar opportunities, and we will be bringing similar portfolios and assets to our investors.